Similar to the consumer staple dividend stock analysis series (including CLX [1], CL [2], KMB [3], PG [4], JNJ [5]) I published in October, I am starting a new one on Canadian utilities dividend stocks. Canadian utilities can be quite interesting for both Canadian and US investors as they offer great diversification within their power sources. They show great strengths in both oil (pipelines) and electric power plants. Here’s the list of Canadian companies that will be cover before Xmas:

Emera Inc – EMA

Fortis – FTS [7]

Emera (EMA) Business Description:

Emera is an energy and services company holding $7.4 billion in assets and showing revenues of $2.1 billion (2011). Emera’s focus is through electricity generation, transmission & distribution. EMA owns Nova Scotia Power (province’s main electricity provider) along with other electrical utilities in Canada, USA and the Caribbean.

Over the past 5 years, EMA made a major switch in its energy sources. Back in 2011, 57% of its energy came from coal compared to 80% 5 years ago. Let’s hope they continue this way and look for cleaner energy sources. They are notably working on hydro electric power plants along with developing wind energy.

EMA Stock Graph

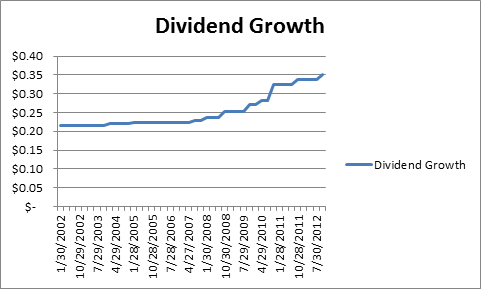

[9]EMA Dividend Growth Graph

[9]EMA Dividend Growth Graph

EMA dividend growth has been shy for a few years but, much the opposite of ECA [6], Emera started to increase its dividend at a relatively good rate since 2007. The huge EPS boost that happened 5 years is certainly linked to dividend payout strategy. More recently (from 2009 to 2011), the EPS growth has been in line with the dividend growth. The company seems comfortable with a payout ratio around 65%. The 5 year dividend growth is 8.65% which could double the dividend payout every 8 years or so.

The Company Ratios and Financial Info:

Ticker EMA

Name Emera Inc

Dividend Metrics

Current Dividend Yield 4.09

5 year Dividend Growth 8.65

1 year Dividend Growth 3.81

Company Metrics

Sales Growth (1 year) 28.53

Sales Growth (5 year) 9.62

EPS growth (5 year) 96.59

P/E ratio 17.81

P/E Next Year 19.08

Margins growth -6.52

Payout ratio 65.82

Return on Equity 14.77

Debt to Capital Ratio 0.88

When I look at the financial info, I have the impression of reading ECA’s report [6] upside down to tell you how Emera is different than Encana even though both company names are similar ;-). The sales numbers are strong and the company is profitable.

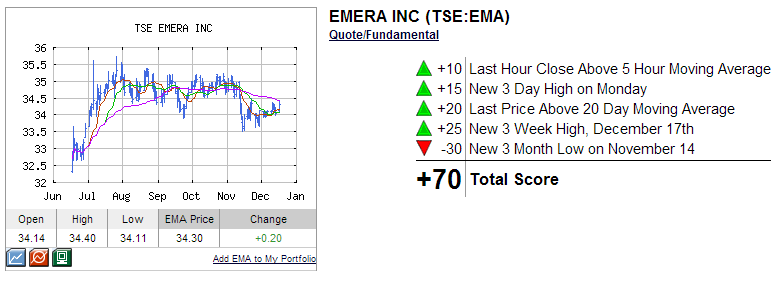

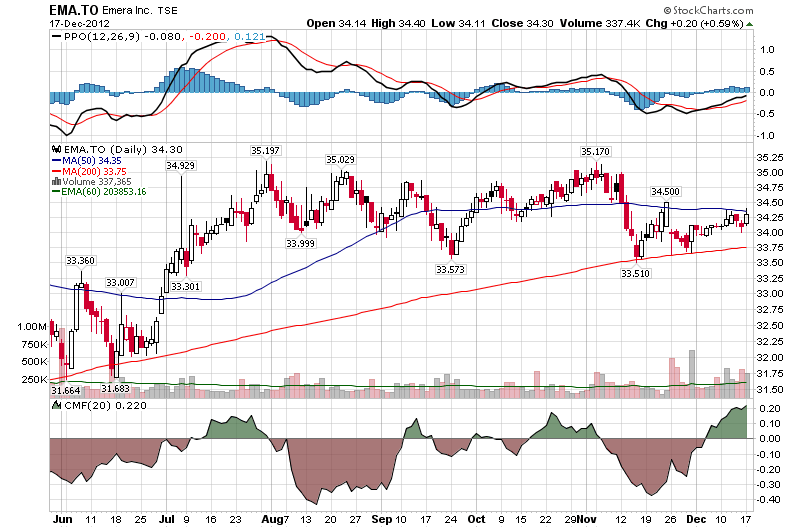

EMA Stock Technical Analysis

EMA is currently trading on a strong uptrend. It might be a good opportunity to acquire this stock. Click here to get a free stock analysis report on EMA [11].

Emera Upcoming opportunities and dangers:

There is a big chunk of EMA revenues coming from Nova Scotia Power which concentrates its income source. In 2012, two large industrial clients in NS closed their operations and therefore cut Nova Scotia Power sales by almost 20%. This loss has wiped-out the positive impact of higher power rates. On a positive note, the sales drop barely affected EMA’s overall results (-0.1% as at June 2012). This is mainly due to a higher cost of energy charged to its other clients.

Emera’s will for diversification is demonstrated by the implication in a 29% participation in the Maritime Link project in Labrador along with an undersea power cable. Both projects currently await regulators approval and, if approved, should start in 2017.

Final Thoughts on Emera

I’m still bugged by the fact that EMA produces 57% of its energy from coal but the new projects are all related to cleaner energy sources which is great news. Out of the four Canadian utilities dividend growth analysis I’ve done, EMA and FTS seems like the best investments. EMA is paying a higher dividend yield but FTS shows highly stable numbers for the past 4-5 years. Emera has gone through an important jump and this is why I would be tempted to look at FTS first… just my two cents! What do you think? Which one if your favourite?

Disclaimer: I do not hold EMA, ECA, FTS in my portfolio

Google+ [12]