Following my analysis on Mattel (MAT) and Hasbro (HAS) from last week, I’m closing this toy stock series with the most famous company in the eyes of children: The Walt Disney Company (DIS).

Note: The stock is currently showing a dividend yield of 1.14%. This definitely does not fit my Dividend Growth Investing Model. But the company has recently started to increase its dividend and it makes a great comparison to Mattel and Hasbro who are pretty much alone in the toy industry paying distributions over 3%.

Disney (DIS) Business Description:

If you have been hiding under a rock for the past 80 years, you may ignore that Disney is THE reference for family entertainment. The company is divided into four sectors:

#1 Media Networks (ABC Family, ESPN, Disney Junior, etc)

#2 Parks & Resorts (you need to visit one in your life)

#3 Studio Entertainments (Pixar, Walt Disney Pictures, Marvel banners)

#4 Consumer Products (Mickey Mouse, Cars, Disney Princess, Winnie the Pooh, Toy Story, etc, etc, etc)

Founded in 1923 by Walt & Roy Disney as The Disney Brothers Cartoon Studio, Disney is today the world’s largest media conglomerate in terms of revenues. Disney has recently hit several home runs with the acquisition of Marvel where they pump a Heroes movie out every six months. After the huge box office success Avengers in 2012, Disney is coming back this year with Iron Man 3 and Thor – The Dark World. This is not to mention their animation studios produced Brave, Frankenweenie & Wreck-it-Ralph (which I really liked!) all in the same year.

The ability to generate important movie success is amplified tenfold by their talent to produce fifty-six-billion of connected consumer products. As it wasn’t enough, Disney bought the license to “close” the Star Wars story with the “last” trilogy.

DIS Stock Graph

DIS Dividend Growth Graph

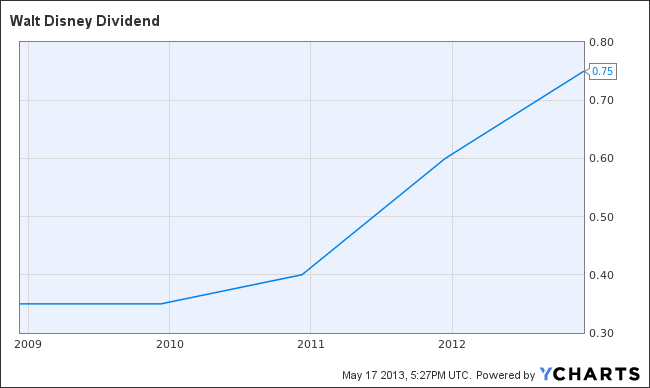

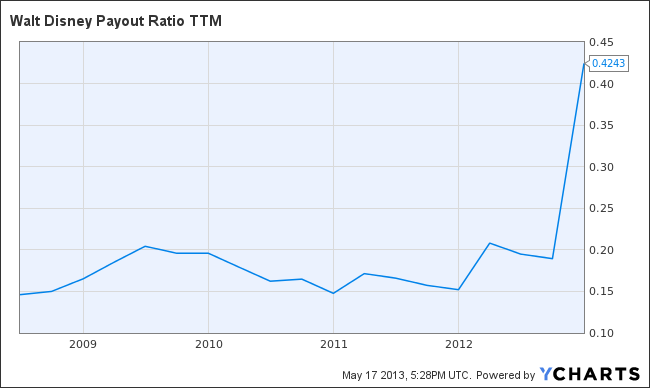

As I mentioned at the beginning of my analysis, DIS is not known as a super powered dividend stock. With a small yield of 1.14%, it could never be part of my portfolio. However, the recent dividend payout growth is interesting if management keeps it this way. The dividend growth over the past 5 years is at 16.47% while they made a big jump last year as per the following graph:

Most importantly, Disney shows they have huge room to increase their payout in their future with a current payout ratio under the bar of 50%.

But don’t get me wrong, with their massive projects, Disney requires a lot of liquidity to fund them and apply their magical marketing recipe. If I had the choice, I think I would buy the Disney marketing recipe over Coca-Cola’s magic formula ;-).

The Company Ratios and Financial Info:

Ticker DIS US Equity

Name Walt Disney Co/The

Dividend Metrics

Current Dividend Yield 1.16

5 year Dividend Growth 16.47

1 year Dividend Growth 25

Company Metrics

Sales Growth (1 year) 3.39

Sales Growth (5 year) 1.83

EPS growth (5 year) 6.91

P/E ratio 20.92

P/E Next Year 16.53

Margins growth 1.74

Payout ratio 18.94

Return on Equity 14.31

Debt to Capital Ratio 0.15

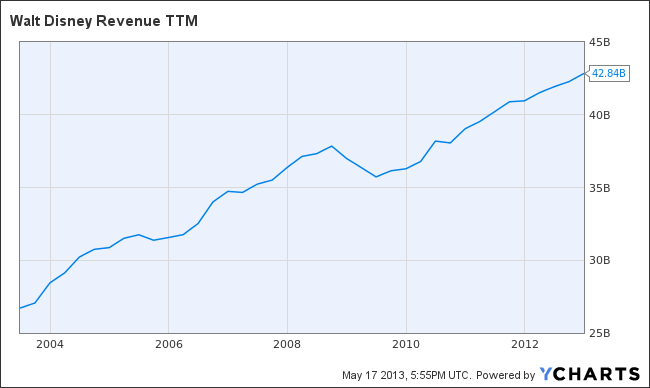

When I look at the numbers, I can’t be disappointed. Both sales AND profits are up while the company boosts its dividend. You can even go back ten years and still see an awesome growth in revenues:

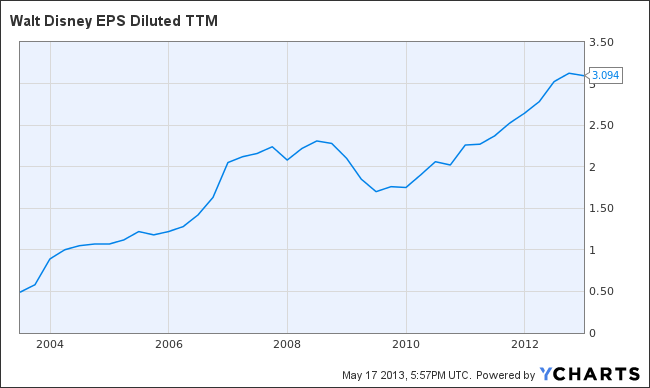

Same story with the earnings:

We can see that after the economic crisis of 2008, they rapidly recuperated their swing to boost 2011, 2012 and now 2013 sales and profits. The company is definitely solid.

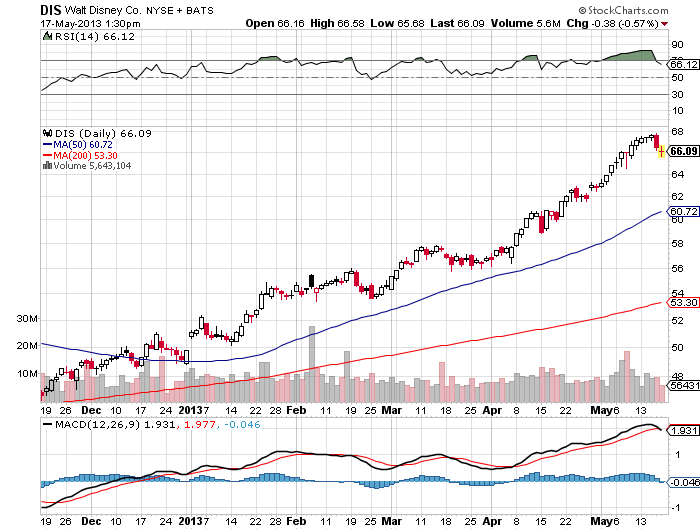

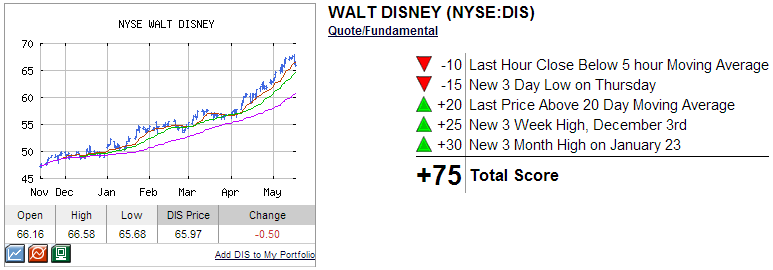

DIS Stock Technical Analysis

DIS is currently trading on a strong uptrend. It might be a good time to acquire this stock. Click here to get a free stock analysis report on DIS [6].

Disney Upcoming opportunities and dangers:

With such a large brand portfolio coupled with multiple acquisitions, Disney counts on several opportunities to continue to grow. Since Americans have cleared a part of their debts during the past three years, chances are they are more inclined to spend more in the upcoming years in entertainment.

The other point that convinced me about the company was my personal trip to Disney World last winter with my three kids. Everything was perfect. I mean EVERYTHING. Their ability to think about the unthinkable and make the customer experience his best family vacation souvenir ever is almost unreal. A company with such dedication to detail is definitely a keeper for a portfolio.

As for the dangers, we often mention their media network division to be at risk seeing possible cable erosion. This could be a possibility if Disney’s brand wasn’t as strong in our minds. Kids will want to see Disney’s cartoon and movies while adults will always be looking forward live sports on TV through ESPN.

The downside? A relatively high P/E ratio currently sitting at 20. Considering the company’s growth potential in the upcoming years (do I have to mention how much money you make on a Star Wars Episode?), this is a calculated risk. Mind you, several great stocks are trading around 20 P/E ratio right now. It might not be the best time to buy the stock, but I don’t think there will be a major pull back either.

Final Thoughts on Disney

The more I read about Disney, the more I’m seduced by this company. It bites me that it doesn’t pay a higher dividend… But I’m still considering this stock as it has been paying a dividend for the past 14 years. Based on my analysis, DIS looks like a great complement to my portfolio. Still, I’m not making any trades at the moment.

Disclaimer: I do not hold shares of MAT, HAS or DIS

Google+ [7]